As Global Wealth Trends: How Ultra High Net Worth Management Is Evolving takes center stage, this opening passage beckons readers with a captivating overview of the topic. It delves into the intricate world of managing ultra high net worth individuals, exploring the key characteristics and the evolving landscape shaped by current global wealth trends and technological disruptions. The narrative extends to the growing importance of sustainable investing and ESG integration for ultra high net worth clients, providing a comprehensive understanding of the subject matter.

Understanding Ultra High Net Worth Management

Ultra high net worth management refers to the specialized financial services and strategies tailored to individuals with a net worth exceeding a certain threshold, typically in the hundreds of millions or billions of dollars.

Key Characteristics of Ultra High Net Worth Individuals

- Ultra high net worth individuals have substantial assets, often diversified across various investment classes.

- They typically have complex financial needs and goals, requiring sophisticated wealth management solutions.

- These individuals may have interests in alternative investments, such as private equity, hedge funds, or real estate.

- Ultra high net worth individuals often have a global presence, with assets and investments in multiple countries.

Reasons for the Differences in Managing Ultra High Net Worth Individuals

- Complexity: Managing ultra high net worth individuals involves dealing with intricate financial structures and strategies due to the large scale of their assets.

- Customization: Wealth management for ultra high net worth individuals requires highly personalized solutions to address their unique needs and objectives.

- Risk Management: With significant assets at stake, managing risk becomes a crucial aspect of ultra high net worth management to preserve wealth.

- Global Reach: Ultra high net worth individuals often have investments and interests in various countries, necessitating expertise in international finance and regulations.

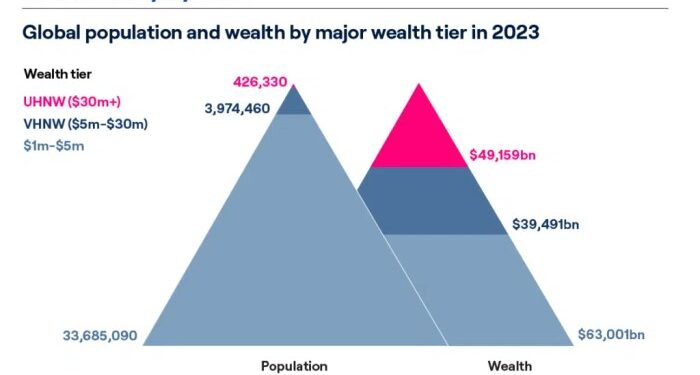

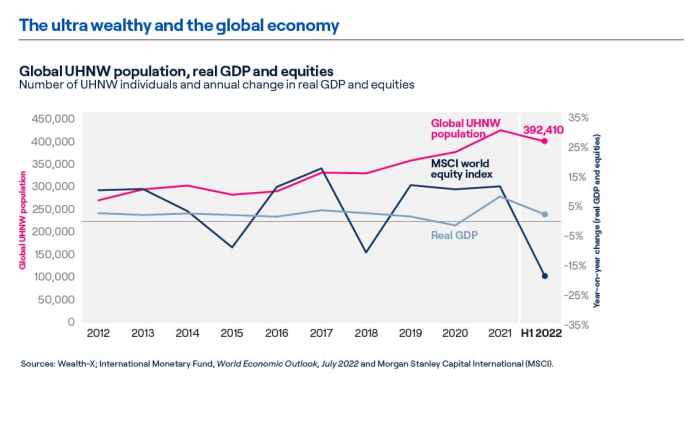

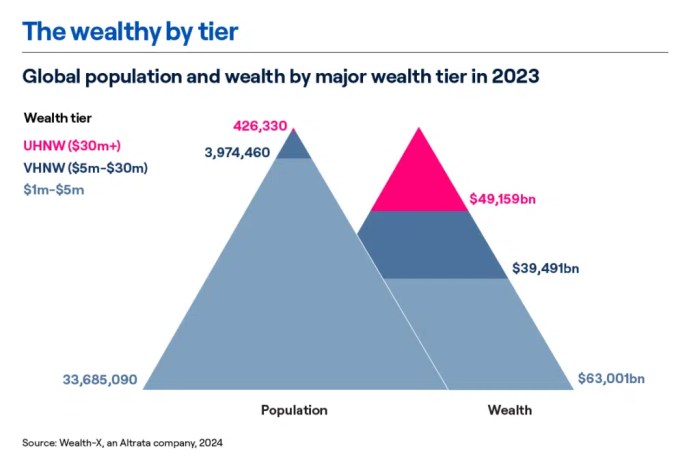

Global Wealth Trends Impacting Ultra High Net Worth Management

As the global economic landscape continues to shift, various wealth trends have emerged that are directly impacting the management of ultra high net worth individuals. These trends have evolved significantly over the past decade, shaping the strategies and approaches used in managing the wealth of high net worth clients.

Shift Towards Sustainable Investing

In recent years, there has been a noticeable shift towards sustainable investing among ultra high net worth individuals. This trend is driven by a growing awareness of environmental, social, and governance (ESG) factors, prompting wealth managers to incorporate sustainable investment strategies into their portfolios.

- Ultra high net worth individuals are increasingly seeking investments that align with their values and beliefs, leading to a rise in ESG-focused investment opportunities.

- Wealth managers are now integrating sustainability criteria into their investment decisions, considering not just financial returns but also the impact of investments on society and the environment.

- Geopolitical events, such as the Paris Agreement on climate change, have further accelerated the shift towards sustainable investing, influencing wealth management strategies to prioritize long-term sustainability and responsible stewardship of capital.

Rise of Technology in Wealth Management

Advancements in technology have revolutionized the way wealth managers interact with ultra high net worth clients, offering new tools and platforms to enhance the client experience and streamline investment processes.

- Wealth management firms are increasingly leveraging artificial intelligence and machine learning to analyze data and provide personalized investment recommendations tailored to the individual needs of ultra high net worth clients.

- Digital platforms have made it easier for clients to access real-time information on their investments and communicate with their wealth managers, improving transparency and efficiency in wealth management services.

- The evolution of robo-advisors and algorithmic trading has democratized access to sophisticated investment strategies, allowing ultra high net worth individuals to diversify their portfolios and optimize risk management.

Technology Disruption in Ultra High Net Worth Management

Technology disruption has significantly altered the landscape of wealth management for ultra high net worth individuals. With the advancement of digital tools and platforms, traditional methods are being transformed to cater to the evolving needs of high net worth clients.Role of AI, Machine Learning, and Automation

- AI and machine learning algorithms are being used to analyze vast amounts of financial data in real-time, allowing for more accurate predictions and personalized investment strategies.

- Automation streamlines processes like portfolio management, risk assessment, and asset allocation, enabling advisors to focus on strategic planning and client relationships.

- Robo-advisors are gaining popularity among ultra high net worth individuals, offering cost-effective and efficient wealth management solutions through automated algorithms.

Digital Platforms Reshaping Client-Advisor Interactions

- Digital platforms provide clients with real-time access to their portfolios, performance metrics, and investment opportunities, enhancing transparency and control over their wealth.

- Virtual meetings and communication tools have facilitated seamless interactions between clients and advisors, enabling quick decision-making and strategic discussions regardless of geographical barriers.

- Data analytics tools help advisors gain deeper insights into client preferences, risk tolerance, and financial goals, allowing for more personalized and targeted wealth management strategies.

Sustainable Investing and ESG Integration for Ultra High Net Worth Clients

As global awareness of environmental and social issues continues to rise, sustainable investing has become a key focus for ultra high net worth individuals seeking to align their wealth with their values. The integration of Environmental, Social, and Governance (ESG) factors in wealth management has gained traction, reflecting a shift towards responsible investing practices.

Importance of Sustainable Investing for Ultra High Net Worth Individuals

- Ultra high net worth clients are increasingly concerned with the long-term impact of their investment decisions on the environment and society.

- By incorporating sustainable investing practices, these clients can not only generate financial returns but also contribute to positive environmental and social change.

- ESG integration allows ultra high net worth individuals to align their portfolios with their values and beliefs, promoting a more sustainable and ethical approach to wealth management.

Integration of ESG Factors in Wealth Management

- Environmental factors consider a company's impact on the environment, such as carbon emissions, resource management, and pollution control.

- Social factors assess how a company interacts with its stakeholders, including employees, customers, and communities.

- Governance factors focus on the leadership, transparency, and accountability of a company, ensuring ethical business practices.

Examples of Successful ESG Strategies for Ultra High Net Worth Clients

- Impact investing: Investing in companies or projects that aim to generate positive social and environmental impact alongside financial returns.

- Socially responsible investing (SRI): Selecting investments based on specific ESG criteria to support companies with strong sustainability practices.

- Engagement and proxy voting: Actively engaging with companies on ESG issues and exercising voting rights to influence corporate behavior towards sustainability.

Concluding Remarks

In conclusion, Global Wealth Trends: How Ultra High Net Worth Management Is Evolving encapsulates the dynamic shifts and innovations driving the management of ultra high net worth individuals. From technological disruptions to sustainable investing strategies, the evolution in wealth management practices is evident. This discussion serves as a valuable resource for those navigating the complexities of managing ultra high net worth clients in an ever-changing global landscape.

Q&A

What does ultra high net worth management entail?

Ultra high net worth management involves specialized financial services tailored to individuals with substantial wealth, focusing on strategies to preserve and grow their assets.

How have current global wealth trends impacted the management of ultra high net worth individuals?

Current global wealth trends have reshaped the strategies and approaches in managing ultra high net worth individuals, emphasizing factors like diversification, risk management, and sustainable investing.

What role does technology play in optimizing wealth management strategies for ultra high net worth individuals?

Technology, including AI, machine learning, and automation, plays a crucial role in enhancing efficiency and personalization in wealth management for ultra high net worth individuals.