Exploring the critical role of Ultra High Net Worth Advisors in Multi-Generational Wealth Planning sets the stage for understanding the complexities and nuances involved in managing wealth across multiple generations. Delve into this insightful discussion to gain a deeper insight into the strategies and services tailored for high net worth individuals and their families.

The Role of Ultra High Net Worth Advisors in Multi-Generational Wealth Planning

Ultra High Net Worth Advisors are financial professionals who specialize in providing comprehensive wealth management services to individuals with extremely high levels of assets and net worth. These advisors have expertise in managing complex financial portfolios and implementing strategies to preserve and grow wealth over multiple generations.

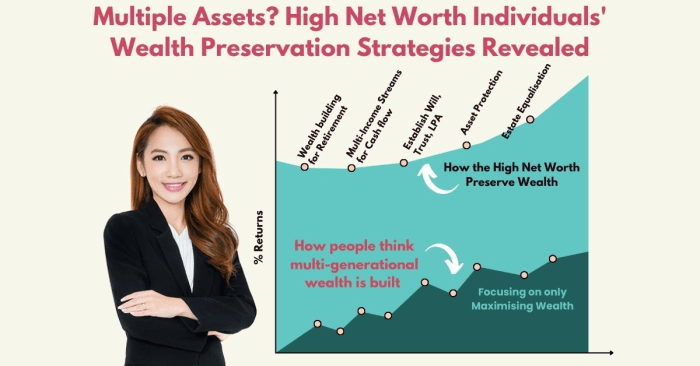

Multi-generational wealth planning is essential for high net worth individuals to ensure the long-term preservation and transfer of wealth to future generations. By creating a strategic plan that takes into account the financial goals and needs of multiple generations, families can secure their financial legacy and provide for their heirs.

Comparison between Ultra High Net Worth Advisors and Traditional Advisors

- Ultra High Net Worth Advisors have specialized knowledge and experience in managing large and complex financial portfolios, including investments, tax planning, estate planning, and philanthropic strategies. They are equipped to handle the unique needs and challenges that come with managing significant wealth.

- Traditional advisors, on the other hand, may not have the expertise or resources to effectively manage the complex financial situations of ultra high net worth individuals. They may lack the in-depth understanding of sophisticated wealth management strategies and the intricacies of multi-generational planning.

- Ultra High Net Worth Advisors often work closely with a team of professionals, including tax specialists, estate planning attorneys, and investment managers, to develop comprehensive wealth management plans that align with the specific goals and values of their clients. This collaborative approach ensures that all aspects of the client's financial situation are carefully considered and integrated into the overall wealth plan.

- Traditional advisors may have a more transactional or product-focused approach to financial planning, which may not be suitable for ultra high net worth clients who require a more customized and holistic wealth management strategy. They may also lack the resources and connections to provide access to exclusive investment opportunities or specialized services that ultra high net worth advisors can offer.

Understanding the Needs of Ultra High Net Worth Clients

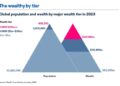

Ultra High Net Worth (UHNW) individuals face unique financial challenges due to the complexity and scale of their wealth. These clients require specialized services and strategies tailored to their specific needs in multi-generational wealth planning.Unique Financial Challenges Faced by UHNW Individuals

- Asset protection: UHNW clients need sophisticated strategies to safeguard their wealth from risks such as lawsuits, creditors, and divorce settlements.

- Estate planning: Managing a large estate requires careful planning to minimize tax liabilities and ensure a smooth transfer of assets to future generations.

- Philanthropy: UHNW individuals often have charitable intentions that require strategic planning to maximize the impact of their donations.

Specific Services and Strategies for UHNW Clients

- Family office services: Providing comprehensive financial management services, including investment management, tax planning, and estate planning, tailored to the unique needs of UHNW families.

- Alternative investments: Offering access to exclusive investment opportunities, such as private equity, hedge funds, and real estate, to diversify and grow the UHNW client's portfolio.

- Succession planning: Developing a customized plan to transfer wealth to future generations while minimizing tax implications and maintaining family harmony.

Examples of Successful Wealth Planning Solutions

- Establishing a family foundation to support charitable causes while involving multiple generations in philanthropic activities.

- Creating a trust structure to protect assets and provide for the financial security of heirs while maintaining control over the distribution of wealth.

- Implementing a strategic investment plan that balances risk and return to grow the UHNW client's wealth over time and achieve long-term financial goals.

Building Long-Term Relationships with Multi-Generational Families

Establishing trust and rapport with multi-generational families as an advisor is a crucial aspect of providing effective wealth planning services. It requires a deep understanding of the family dynamics, values, and goals to ensure a successful long-term relationship.Key Elements of Communication and Collaboration

- Open and Transparent Communication: Maintaining open lines of communication and being transparent about financial decisions are essential in building trust with multi-generational families.

- Active Listening: Listening to the needs, concerns, and aspirations of each family member allows advisors to tailor their services accordingly and demonstrate genuine care.

- Customized Solutions: Providing personalized and customized solutions that align with the unique goals and values of each generation within the family fosters a sense of partnership and collaboration.

- Regular Family Meetings: Organizing regular family meetings to discuss financial plans, goals, and updates helps in ensuring that everyone is on the same page and promotes unity within the family.

Benefits of Continuity in Advisory Services

- Trust and Confidence: Continuity in advisory services across generations builds trust and confidence in the advisor's expertise and commitment to the family's long-term financial well-being.

- Knowledge Transfer: By working with the same advisor over generations, families can benefit from the transfer of knowledge and insights that are specific to their family's financial history and goals.

- Consistency in Strategy: Maintaining continuity in advisory services allows for consistency in financial planning strategies and ensures that the family's goals and objectives remain at the forefront of decision-making.

- Legacy Planning: Long-term relationships with multi-generational families enable advisors to assist in legacy planning, ensuring a smooth transition of wealth and values from one generation to the next.

Incorporating Tax and Estate Planning in Multi-Generational Wealth Strategies

When it comes to multi-generational wealth strategies, tax and estate planning play a crucial role in preserving and growing assets for future generations. Ultra High Net Worth Advisors are instrumental in guiding their clients through the complexities of tax laws and regulations to ensure efficient wealth transfer.

The Role of Ultra High Net Worth Advisors in Tax Planning for Multi-Generational Wealth

- Ultra High Net Worth Advisors work closely with clients to develop tax-efficient strategies that minimize the tax burden on wealth transfers.

- They stay updated on changing tax laws and regulations to provide timely advice on the most effective tax planning techniques.

- By leveraging their expertise, Ultra High Net Worth Advisors help clients navigate complex tax structures and optimize their financial plans for future generations.

Importance of Estate Planning in Preserving Wealth for Future Generations

- Estate planning is essential for ensuring a smooth transfer of assets to heirs while minimizing tax implications and other potential challenges.

- Ultra High Net Worth Advisors assist clients in creating comprehensive estate plans that align with their wealth transfer goals and protect their legacy.

- Through proper estate planning, families can establish a solid foundation for future generations to build upon and secure their financial well-being.

Navigating Complex Tax Laws and Regulations for Ultra High Net Worth Clients

- Ultra High Net Worth Advisors provide personalized guidance on navigating intricate tax laws and regulations to optimize wealth preservation and minimize tax liabilities.

- They help clients make informed decisions about investment strategies, charitable giving, and other financial tools to achieve their tax planning objectives.

- By collaborating with tax experts and legal professionals, Ultra High Net Worth Advisors ensure that their clients are well-positioned to mitigate risks and capitalize on tax-saving opportunities.

Wrap-Up

In conclusion, The Role of Ultra High Net Worth Advisors in Multi-Generational Wealth Planning highlights the importance of strategic financial planning and relationship-building across generations. By incorporating tax and estate planning into wealth strategies, advisors can secure a prosperous future for their clients and their heirs.

Clarifying Questions

What defines Ultra High Net Worth Advisors?

Ultra High Net Worth Advisors are financial professionals specializing in managing the wealth of individuals with substantial assets, typically in the range of millions or billions of dollars.

Why is multi-generational wealth planning important?

Multi-generational wealth planning ensures the seamless transfer of assets and values across different generations, preserving and growing wealth for the long term.

How do Ultra High Net Worth Advisors differ from traditional advisors in wealth planning?

Ultra High Net Worth Advisors offer specialized services and strategies tailored to high net worth clients, including more complex financial challenges and customized solutions for multi-generational families.