Exploring the realm of preserving wealth in ultra high net worth portfolios unveils a fascinating landscape of strategies and techniques. From traditional methods to innovative approaches, the journey towards safeguarding and growing wealth is both intricate and rewarding.

As we delve deeper into the intricacies of wealth preservation within ultra high net worth portfolios, a rich tapestry of insights and practices emerges, shedding light on the meticulous planning and foresight required in this exclusive financial domain.

Wealth Preservation Techniques

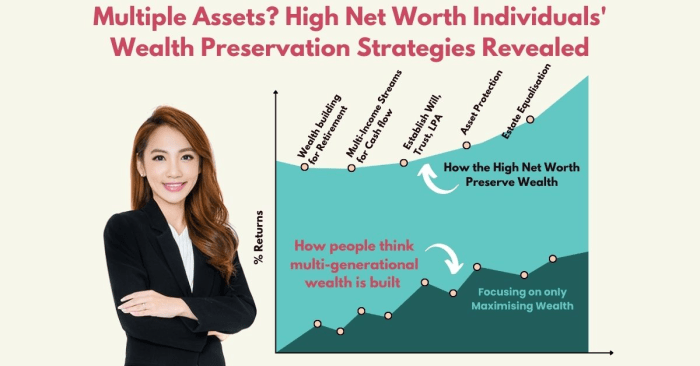

Wealth preservation techniques are strategies employed by ultra high net worth individuals to safeguard and protect their assets from risks and market volatility, ensuring the long-term security and growth of their portfolios.

Traditional Wealth Preservation Strategies

- Diversification: Ultra high net worth individuals often spread their investments across various asset classes to minimize risk and avoid overexposure to any single investment.

- Asset Protection Trusts: Setting up trusts can help protect assets from creditors, lawsuits, and other potential threats, providing a layer of legal protection.

- Estate Planning: Proper estate planning ensures a smooth transfer of wealth to future generations, minimizing tax implications and preserving assets for heirs.

- Insurance: Utilizing insurance products such as life insurance and liability insurance can help mitigate risks and protect assets from unforeseen events.

The importance of wealth preservation in ultra high net worth portfolios cannot be overstated. By implementing effective preservation strategies, individuals can not only safeguard their wealth but also lay the foundation for its continued growth and sustainability over time.

Diversification Strategies

When it comes to preserving wealth in ultra high net worth portfolios, diversification plays a crucial role in mitigating risk and enhancing overall portfolio performance.

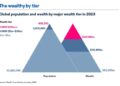

Ultra high net worth individuals typically diversify their portfolios across different asset classes to spread risk and maximize returns. Let's compare and contrast some of the key asset classes that are commonly included in these diversified portfolios:

Asset Classes in Diversification

- Equities: Investing in stocks of publicly traded companies provides the potential for high returns but also comes with higher volatility.

- Bonds: Fixed-income securities offer a more stable source of income with lower risk compared to equities.

- Real Estate: Including real estate investments in a portfolio can provide diversification and potential for long-term appreciation.

- Commodities: Investing in commodities such as gold, oil, or agricultural products can act as a hedge against inflation and currency fluctuations.

Role of Alternative Investments

Alternative investments, such as hedge funds, private equity, venture capital, and real assets like infrastructure and natural resources, play a significant role in diversifying ultra high net worth portfolios. These investments offer unique opportunities for diversification beyond traditional asset classes and can provide higher returns with lower correlation to the stock market.

Risk Management

Hedging Techniques

- Hedging is a common risk management strategy used by ultra high net worth individuals to protect their portfolios from market volatility.

- One popular hedging technique is the use of options contracts, which allow investors to limit their downside risk while still benefiting from potential upside movements.

- Another hedging method is diversification, where assets are spread across different asset classes to reduce overall risk exposure.

Insurance Products

- Ultra high net worth individuals often utilize insurance products such as life insurance, property insurance, and liability insurance to protect their assets and minimize potential losses.

- Insurance can serve as a safety net in case of unforeseen events such as natural disasters, lawsuits, or health emergencies that could jeopardize wealth preservation.

- By paying premiums for insurance coverage, individuals can transfer the financial risk associated with certain events to an insurance company, providing them with peace of mind and added protection.

Tax Planning

Tax planning plays a crucial role in preserving wealth for ultra high net worth portfolios. By strategically managing taxes, individuals can minimize the impact on their wealth and maximize their financial gains over the long term.Tax-Efficient Investment Strategies

- Utilizing tax-advantaged accounts such as IRAs and 401(k)s to defer taxes on investment gains.

- Investing in municipal bonds that offer tax-free interest income at the federal level.

- Harvesting investment losses to offset gains and reduce taxable income.

- Implementing a buy-and-hold strategy to reduce capital gains taxes through long-term investments.

Estate Planning Techniques

- Setting up trusts, such as irrevocable life insurance trusts or charitable remainder trusts, to transfer assets tax-efficiently to beneficiaries.

- Leveraging the annual gift tax exclusion to gift assets to heirs tax-free, reducing the size of the taxable estate.

- Using a family limited partnership to transfer assets to family members at a discounted value, reducing estate tax liability.

- Creating a comprehensive estate plan that includes wills, trusts, and powers of attorney to ensure assets are distributed according to your wishes and minimize tax implications.

Last Point

In conclusion, the art of wealth preservation in ultra high net worth portfolios is a delicate dance between tradition and innovation, risk and reward. By embracing a holistic approach that encompasses diversification, risk management, tax planning, and more, individuals can navigate the complexities of wealth preservation with confidence and foresight.

Frequently Asked Questions

How do ultra high net worth individuals define wealth preservation techniques?

Ultra high net worth individuals define wealth preservation techniques as strategic measures taken to safeguard and grow their wealth over time, ensuring its longevity and sustainability.

What role do alternative investments play in diversifying ultra high net worth portfolios?

Alternative investments play a crucial role in diversifying ultra high net worth portfolios by offering opportunities outside traditional asset classes, thereby reducing overall risk exposure and enhancing potential returns.